We make the markets

with one goal in mind:

BUILDING YOUR TOKEN’S VALUE

We do this by:

Making token easy to buy

We will increase the availability of your token and lower the costs of entry for your investors by keeping healthy market depth and tight spreads. We will show you metrics of our activity and we will monitor them jointly every day.

Increasing organic volumes

We will not allow any missing opportunity for your token to increase in volume and price. Whenever an investor decides to buy your token, we will wait with our offers. And we are everywhere your investors are currently trading, covering both Decentralized and Centralized Exchanges.

Increasing organic volumes

We will not allow any missing opportunity for your token to increase in volume and price. Whenever an investor decides to buy your token, we will wait with our offers. And we are everywhere your investors are currently trading, covering both Decentralized and Centralized Exchanges.

You will have direct access to our trading team to discuss current events

You will monitor our proceedings with detailed reports showing you current liquidity situation on your pairs

Liquidity of your token will be provided by our system and set of algorithms, operating since 2015 on major stock and crypto exchanges.

We are recognized as:

* Designated market maker on reputable exchanges * Trusted partner for leading token projects * Laureate of the Deloitte Technology Fast 50 * Mentor of the Cointelegraph Acceleration Program 2023

WHAT DRIVES INVESTORS AWAY FROM TRADING A TOKEN?

Price volatility

If there is no liquidity in order books or pools (low market depth), it means that there are relatively few buy and sell orders at these price levels. It makes the market susceptible to rapid price changes even when a relatively small trade is executed. High price volatility can impact the project’s stability and rise the investor’s risk.

Suspicious metrics

Unfair practices are easy to recognize. When there is no market depth (+-2% Depth) with high trading volume, there is an increased probability that the reported metrics may not reflect actual trading activity. Unhealthy markets lower investors’ confidence and discourage them from trading the token.

A wide spread and a high slippage

Spread, along with slippage, has a direct impact on investors’ entry and exit costs. Investors hesitate to commit funds if they face challenges in entering but, just as importantly, in liquidating positions at any time at the lowest cost. This is the reason that liquidity must be provided 24/7. High transaction costs make a token less attractive.

Market maker helps overcome these problems

Our algorithms ensure market depth, stabilize the price and offer investors constantly good trading conditions, which, as a consequence, contributes to an increase in organic volumes. There is no need for shortcut practices.

POSITIVE ROLE OF LIQUIDITY – CASE STUDIES

We work with mature web3 projects, middle-size tokens, and web3 startups from all segments of the cryptocurrency industry. On average projects working with us we achieve 45-65% of organic volume growth in the first three months. Below, you can learn more about our offerings from the case studies of our most exciting projects.

CASE 1: MAKING GREAT TOKEN EVEN GREATER

Goals achieved so far:

- We have increased market depth in +-2% range by: 65% (MEXC), 100% (Bitfinex), 202% (Crypto.com), 554% (Bitmart)

- Spreads narrowed to 0.19%,

- Slippage on Uniswap minimized below 1% for a $5k swap. We will take it further down, but we must be careful of the high volatility the token is experiencing.

- Our market share averages 26% of daily volume

- Organic volume growth of up to 125% after 6 weeks on selected platforms

- Daily price volatility decreased to a maximum 9% from previous 165%

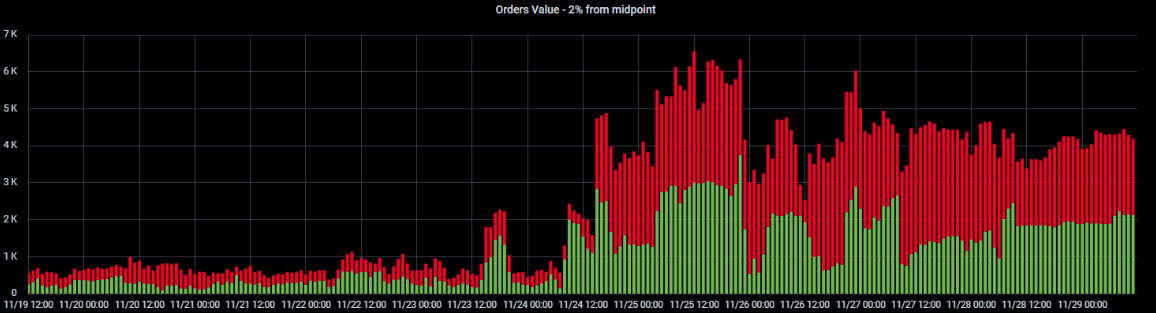

Market Depth (Bitmart)

In this chart, the green/red bars reflect bid and ask values +-2% from the current price. We’ve improved the market depth by 554.52%. This made our share in the most actively trading zone on this market equal to 88.83%.

We partner with a mature token project with a global recognition listed on over 30 markets with significant trading volumes. It has a large and active community. When we started our cooperation, the token had a pool on Uniswap v3 with almost no volumes there.

Our role was to drive the expansion on DEXes and increase liquidity on a few chosen centralized exchanges.

Goals achieved so far:

- We have increased market depth in +-2% range by: 65% (MEXC), 100% (Bitfinex), 202% (Crypto.com), 554% (Bitmart)

- Spreads narrowed to 0.19%,

- Slippage on Uniswap minimized below 1% for a $5k swap. We will take it further down, but we must be careful of the high volatility the token is experiencing.

- Our market share averages 26% of daily volume

- Organic volume growth of up to 125% after 6 weeks on selected platforms

- Daily price volatility decreased to a maximum 9% from previous 165%

Market Depth (Bitmart)

In this chart, the green/red bars reflect bid and ask values +-2% from the current price. We’ve improved the market depth by 554.52%. This made our share in the most actively trading zone on this market equal to 88.83%.

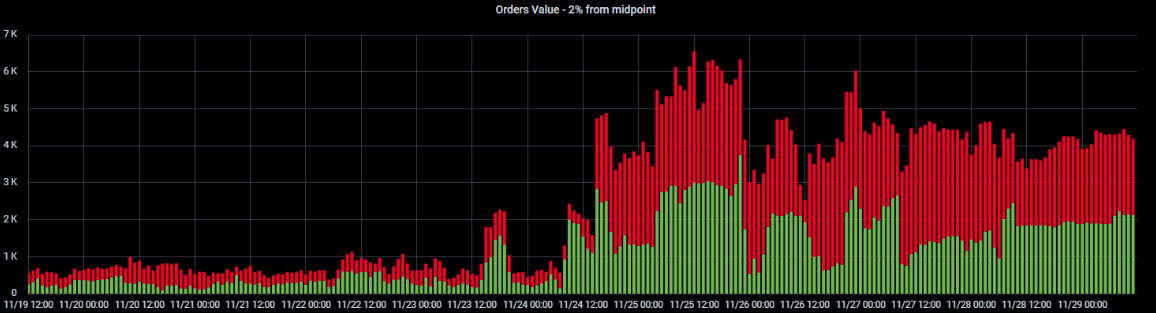

Market Depth (Bitmart)

The chart above shows market volume (green bars, left scale) and our market share in percent (blue line, right scale). We typically average 16-29% of the daily market share in project’s volume. You can also see that at the moment our algorithms entered the market, volumes reflected almost immediately.

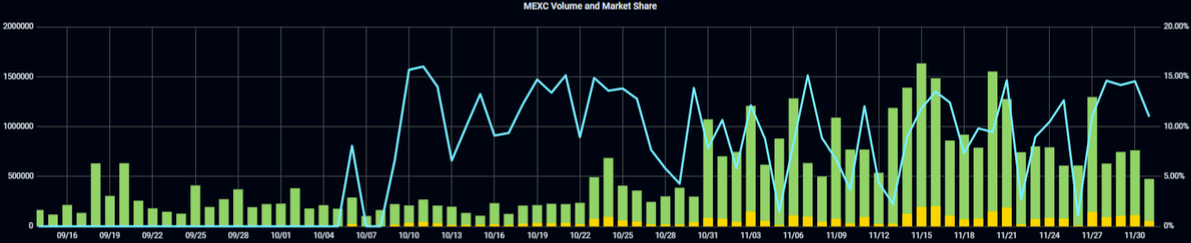

Spread (Crypto.com)

Our operations decreased the market spread from 0.6% to average 0.19% and keep it stable over time, which indicates a healthy market.

Spread (Crypto.com)

Prior to our entry into this market, price volatility reached 165%! The stabilization of prices (with a maximum volatility of 9%) was reflected in an increase in volume.

CASE 2: EXPANSION ON TWO FRONTS - CEXES AND DEXES

We are partnering with the middle-size token project that was initially focused on DEX platforms with four markets on Uniswap v3 (Ethereum and Polygon). At the beginning of our cooperation, the project had moderate liquidity with some depth in pools but with low organic trading volumes.

Our role was to build liquidity in all pools on Uniswap and support new listings on CEX platforms.

Goals achieved so far:

- Successful listing on MEXC with our support as the only market maker backing the listing

- Our avg. daily market share (44.46% on MEXC, 82,2% on Uniswap-Ethereum, 44,7% on Uniswap-Polygon)

- Our liquidity share on MEXC in +-2% depth equal to 73.7%

- Spreads kept near 0,5% after the listing

- Slippage on Uniswap (Ethereum) for $5000 swap minimized to 0,61%

- Slippage on Uniswap (Polygon) for $5000 swap minimized to 1,18%

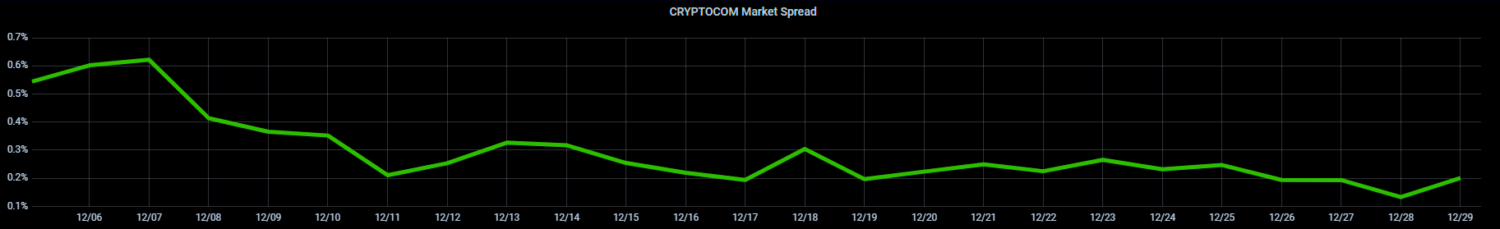

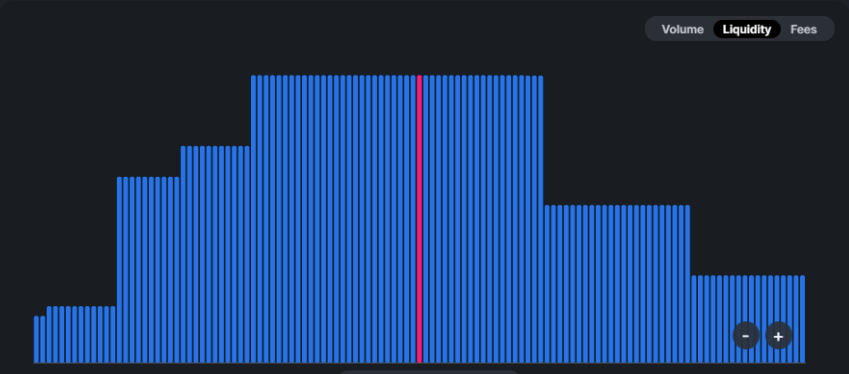

Market Depth (Bitmart)

Uniswap liquidity pool with keeping a constant level of slippage calculated currently as 0,61% for a $5000 swap.

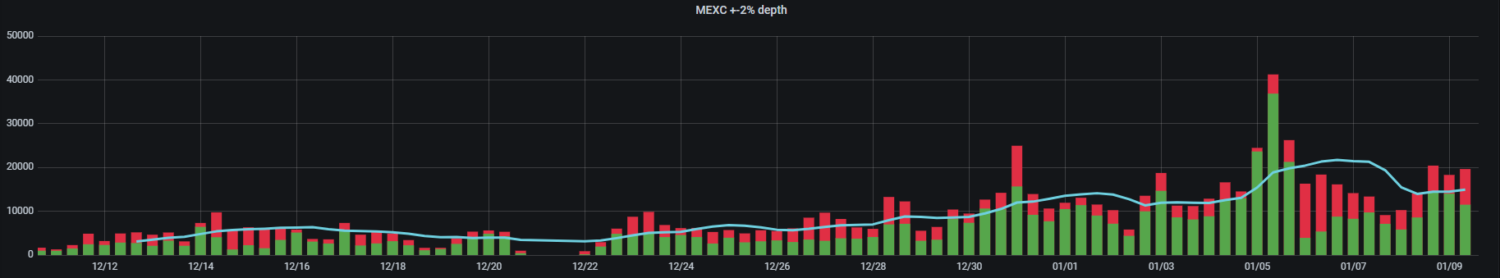

Market depth (MEXC)

In this chart, the green and red bars reflect bid and ask values +-2% from the current price. Our liquidity positions made a 319% increase in this market depth.

CASE 3: SUCCESSFUL TOKEN DEBUT DURING THE BEAR MARKET

We are partnering with a web3 gaming startup that introduced a product with solid fundamentals and a clear use case. We supported token debuts on chosen centralized exchanges by providing initial deep liquidity for substantial trades from the first seconds it went public. What we really like in this project – they have a very enthusiastic community, which translated into rapid growth in volumes and price right after listing.

Our role was to support token debut on three centralized exchanges as the only market maker responsible for listings.

Goals achieved so far:

- Three successful token debuts

- Price increase of 250% in the first week after launch

- Token ranked around position no 800 on CoinMarketCap after 2 weeks from the debut

- Hundreds of thousands of organic volumes are traded daily on each of the markets. On Uniswap v3 only, the average daily volume was $446.8K, with daily spikes exceeding $600K.

Market depth (MEXC)

The price increased up to 250% within the first week after listing, and remains stable after the first month. Since the listing, volumes have begun to rise significantly, reflecting a healthy market and good trading conditions.

Schedule a call with us and check how we can help your project

WE BUILD LISTING STRATEGIES, SUPPORT TOKEN DEBUTS, PROVIDE INITIAL- AND LONG-TERM LIQUIDITY ON MOST CRYPTO EXCHANGES

- Which exchanges are worth listing on?

- Is it more advantageous to prioritize CEXes or DEXes? Which of them holds the most value for a listing?

- What are the listing costs on each exchange? Why opt for a CEX listing when DEX offers a more economical alternative?

- How many pairs are best to create? Which instruments are worth quoting our token to?

- In what order to schedule listings? Is it CEX or DEX first? Which specific exchanges to start with?

- What initial price should be set? What is the optimal value to kickstart a token’s market journey?

- How to protect yourself from snipe bot attacks during the initial DEX listing?

To meet these challenges, our role goes beyond providing an initial liquidity during listing. Today’s listing requires a comprehensive approach, and our services include extensive support in this area.

Our role in supporting the listing process

EXCHANGE SELECTION

Advice on selecting exchanges that align with the project’s objectives in both CEX and DEX arenas.

INTRODUCING TO LISTING TEAMS

Introducing to verified listing teams. Prevent listing scams by verifying listing managers and communication channels.

NEGOTIATION

Assist in the listing negotiation process in regard to price and KPIs.

LIQUIDITY

Ensuring both initial and long-term liquidity for the listed token, fulfilling the exchange’s KPIs.

PRICE STABILIZING

Stabilizing prices across CEX and DEX platforms.

Listing is more than just negotiating fees with an exchange and successful listings require active involvement of a market maker. We have been there, done that. We know how to go through this process smoothly.

LIQUID SERVES AS DESIGNATED MARKET MAKER ON REPUTABLE EXCHANGES WITH SIGNIFICANT MARKET SHARE IN EUROPE, AMERICA AND ASIA

FROM INSIDE OF OUR TECHNOLOGY

We provide good trading conditions 24/7 , 99% uptime. Let the numbers speak about our technology:

We have five cloud data centers in main geographical locations

It processes 4 million messages per minute (market data, financial transactions, logs), and it does it continuously, without delays

We have five cloud data centers in main geographical locations

The system is connected already to over 50 exchanges and we scale it further

The system is connected already to over 50 exchanges and we scale it further